Why Your Canadian Credit Card Insurance is Useless in Japan (A Forensic Analysis)

The Erosion of the Safety Net.

As Canadians, we are conditioned to believe in the safety net. We assume that between our provincial health plans (OHIP, MSP) and our premium credit cards (Visa Infinite, World Elite), we are covered. We check the "Travel Insurance" box on the credit card application and forget about it. But after conducting a forensic analysis of the certificates of insurance against the reality of the Canada-Japan corridor, I have some bad news: The safety net has disintegrated.

Effective January 2020, Ontario (OHIP) eliminated out-of-country emergency coverage entirely. You get $0. In British Columbia, MSP pays a maximum of $75 per day for emergency inpatient care. To put that in perspective: A hospital bed in Tokyo costs between $500 and $1,000 per day. An ICU bed is $5,000+. Your provincial plan covers less than 1% of the bill.

This leaves your credit card as the primary payer. And structurally, most credit cards are not designed to handle the six-figure financial violence of a medical emergency across the Pacific. The "Senior Cliff": Coverage Evaporates at Age 65 This is the most dangerous clause for retired travelers.

If you are under 65, your premium card might cover you for 21 days. But the moment you turn 65, look closely at the "Certificate of Insurance." For cards like the TD Aeroplan Visa Infinite or RBC Avion, coverage for those 65+ often drops to just 3 or 4 days. The flight to Japan takes a day.

By the time you get over your jet lag, your insurance has expired. You are wandering Tokyo uninsured. While "top-ups" are available, they essentially bind you to the bank's restrictive terms—which leads us to the next trap. The "Stability Clause" Trap Credit card policies are rigid.

They operate on a pass/fail system regarding Pre-Existing Conditions. They typically mandate a "Stability Period" of 90 to 180 days. This means there must be NO changes to your health in that window.

Here is the kicker: Insurers define "change" as any adjustment to medication—even a decrease. If your doctor lowers your blood pressure medication two months before your trip because you are getting healthier, the insurer views that as "unstable." If you have a heart attack in Kyoto, your claim can be denied because your condition changed within the 90-day stability window.

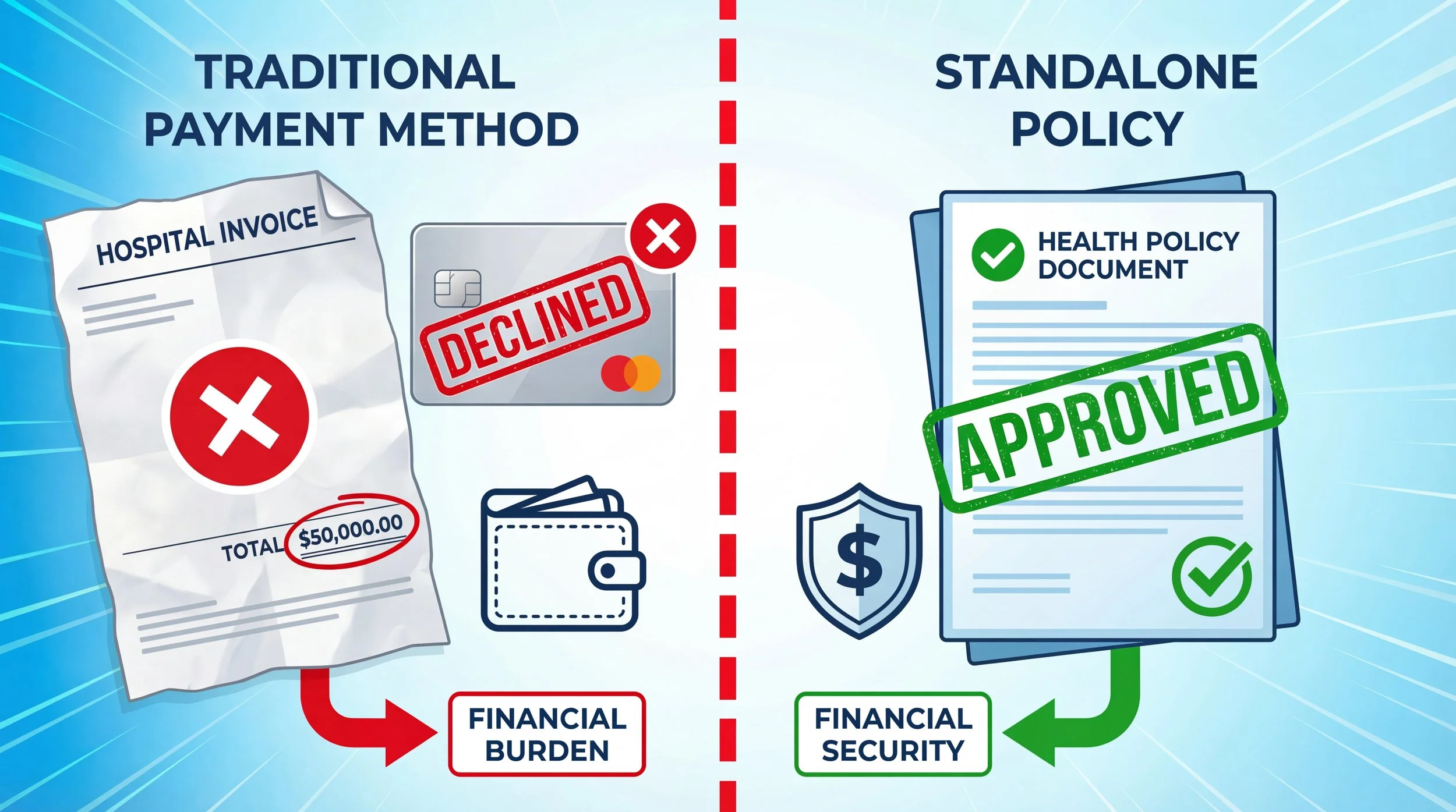

Standalone policies offer "Reduced Stability Riders" (often down to 7 days) or individual underwriting that can cover these changes. Credit cards do not. The Liquidity Crisis: Pay-and-Claim vs. Cashless Japan operates on a strict "pay first" or "guarantee first" basis for tourists. Credit card insurance usually works on a "Pay and Claim" model.

You pay the $20,000 hospital deposit on your card, and they reimburse you months later. But what if you don't have $20,000 in available credit? What if the hospital doesn't take foreign credit cards (a common issue in clinics)?

Specialized insurers like TuGo operate on 'Direct Billing' networks. They have contracts with Japanese hospitals and offer specialized riders that can reduce the stability period to just 7 days—features generic bank plans simply don't have.

They issue a "Guarantee of Payment" (GOP) instantly, bypassing your wallet entirely.

Repatriation: The $200,000 Flight The biggest financial risk in Japan isn't the surgery; it's the flight home. Air ambulance repatriation from Asia to Canada costs between $150,000 and $270,000 CAD. Credit card policies often cap benefits or have strict definitions of "repatriation."

If the medical director decides you can be treated in Tokyo, they won't fly you to Toronto. You are stuck there. Standalone policies often have much higher caps ($5M to $10M) and broader definitions that allow for repatriation based on compassionate grounds, not just strict medical necessity.

Preserving your peace in Japan is an intentional act. If you’ve spent your retirement savings on a dream trip to see the cherry blossoms, don't shatter that feeling by realizing you are uninsured because you turned 65 last week. I’ve found that the best way to bridge the gap between "provincial exposure" and "total security" is to purchase a Comprehensive Standalone Travel Policy with a CFAR (Cancel For Any Reason) rider.

For a fraction of your flight cost, you buy 7-day stability clauses, direct billing capability, and the certainty that a change in medication won't bankrupt you. Read my full guide to Canadian Travel Insurance options here.

Conclusion The assumption that your credit card is "good enough" is a relic of the past. The provincial safety net is gone. The costs in Japan are too high. The clauses are too strict. If you are traveling to Japan from Canada, treat your credit card insurance as a backup for lost luggage, not a lifeline for your health. Buy a real policy.